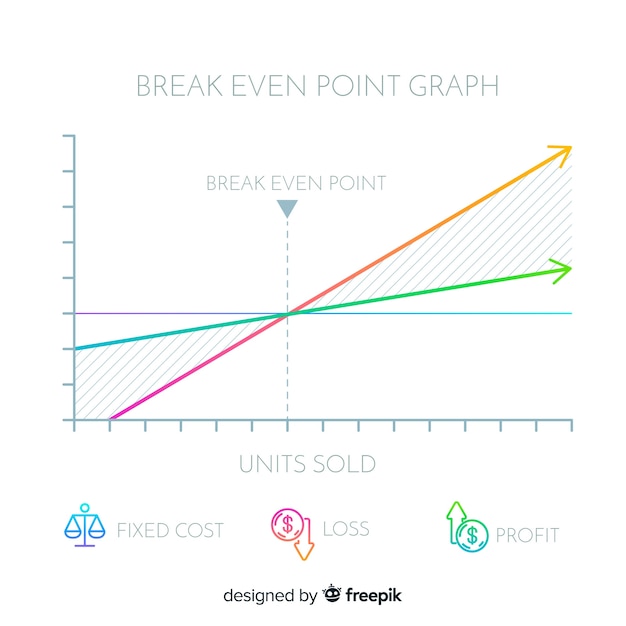

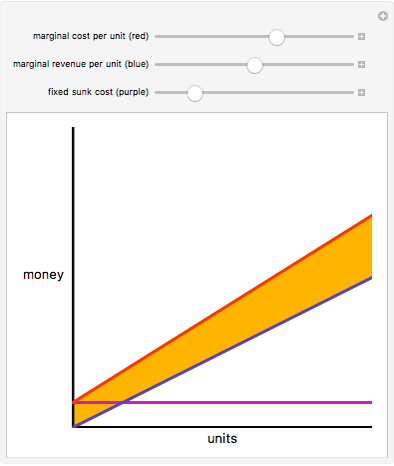

Profit = Revenue – Variable Cost – Fixed Cost.Variable Costs = Cost per Unit x Unit Sold.In Excel, enter proper formulas to calculate the revenue, the variable cost, and profit.Make an easy table, and fill in items/data.You want to forecast the possible sales volumes, and use this to price the product. You already know the per unit variable cost and the total fixed cost. Calculate break-even analysis with a chartĬalculate break-even analysis with Goal-SeekĬase : Supposing you want to sale a new product.Calculate break-even analysis with a formula.Calculate break-even analysis with Goal-Seek Feature (a built-in Excel tool).Natural units: fixed cost / (price - average variable costs).īearing this in mind, there are a number of ways to calculate the break-even point in Excel:.Monetary equivalent: (revenue*fixed costs) / (revenue - variable costs).You can calculate the break-even point with regard to two things: Thus:Ĭontribution Marin = Selling Price - Variable Costs Break-Even Point Formula in Excel Ī key component of calculating the break-even analysis is understanding how much margin or profit is generated from sales after subtracting the variable costs to produce the units. Revenue is Unit Price * Number of units sold.Total Variable Costs include things like direct material, commissions, billable labour, and fees, etc.Total Fixed Costs are known items such as rent, salaries, utilities, interest expense, amortization, and depreciation.Total Fixed Costs (TFC) + Total Variable Costs (TVC) = Revenue To find the break-even, you need to know: The lower the break-even point, the higher the financial stability and solvency of the firm.īreak-even analysis is critical in business planning and corporate finance because assumptions about costs and potential sales determine if a company (or project) is on track to profitability.īreak-even analysis helps organizations/companies determine how many units they need to sell before they can cover their variable costs and the portion of their fixed costs involved in producing that unit. Usually, this indicator is expressed in quantitative or monetary units. In the economic sense, the break-even point is the point of an indicator of a critical situation when profits and losses are zero. At this point, the business can cover all its costs. The break-even point of a business is where the volume of production and volume of sales of goods (or services) sales are equal.

#Break even graph how to#

In this post, we focus on how to use Excel to calculate Break-Even analysis. It occurs after incorporating all fixed and variable costs of running the operations of the business.

How to calculate Break-even analysis in Excelīreak-even analysis is the study of what amount of sales or units sold, a business requires to meet all its expenses without considering the profits or losses.

0 kommentar(er)

0 kommentar(er)